General Principles

- Know where protective stop will be (ALWAYS use it) set before entering the order – if it’s too far away, look for other stock or wait to purchase when safer level forms

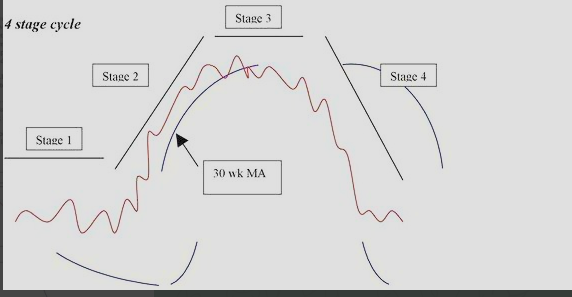

- Never sell a stock in Stages 1 or (especially) 2, AND never buy a stock in Stages 3 or (especially) 4 – stage analysis can be applied to any investments that are governed by supply and demand

- Never guess a bottom (and go long)

- Don’t feel that one has to be 100% invested all the times. Differentiate when charts and indicators point to fully invested and when to extreme caution

- Always be in harmony with the market – buy Stage 2 strength; sell Stage 4 weakness

- In case of conflict between price and volume action and the earnings, always go with objective message being supplied by technical approach

- Always stay consistent. Keep a diary and analyze actions

READING CHARTS

Daily for very short traders, weekly for intermediate (several months) traders. Below specifically on weekly charts:

- Look at each high-low-close spike – forming pattern with insight into next major move

- Look at volume plot – very important that volume is large and expanding on breakout

- Look at 30-week MA – never long if price below declining 30-week MA; never short if price above rising 30-week MA

- Be aware of its long-range background (yearly high-low, long-term support/resistance)

- Look at its relative-strength line – long on uptrend, short on downtrend; watch those situations where it shifts direction

4 Stage Cycle

Stage 1 → Stage 2 → Stage 3 → Stage 4